Interactive Teller Machine (ITM) Buyer’s Guide

For financial institutions seeking innovative cash automation and banking technology solutions that elevate the consumer experience and enhance operational efficiency in a rapidly changing digital world.

TAKE A COPY WITH YOU

Welcome to Your Financial Institution’s Definitive ITM Buying Guide

It’s an exciting time for financial institutions looking to address new opportunities and challenges in the branch environment. Expansion in banking technology has only continued in recent years, moving us well beyond more traditional cash automation and ATM solutions to robust self-service innovations, such as interactive teller machines (ITMs).

No matter where you are in the ITM buying journey — whether you’re still on the fence about making the leap from ATMs, or you’re already committed (at least in part) to making ITMs a part of your strategy — this resource is designed for you. It will provide you with valuable insights into this next-generation self-service technology while also taking into account the radical changes we’ve seen across the industry in consumer behavior in recent years.

From strategy development and solution implementation to transparent pricing and potential challenges, this ITM buyer’s guide is designed to empower you with the knowledge you need to help make more informed and confident decisions every step of the way. If you find yourself with more questions by the end of this guide, please do not hesitate to contact us.

Since first hitting the market more than 15 years ago, ITMs have only grown in popularity among financial institutions nationwide. This is due to their expanded capabilities that meet the increased self-service needs of their consumers, as well as the increased importance of streamlining operational costs for financial institutions.

As a result, an increasing number of FIs just like yours are beginning to critically evaluate how ITMs can play a key role in both their short- and long-term strategic plans.

- For instance, will ITMs eventually render ATMs obsolete?

- Is now the right time to start investing in this type of technology, since the choices you make today for your FI must also carry you forward well into the future?

To help you answer these questions for your own organization, let’s take a look at the four primary drivers behind the increased demand for ITM technology, as well as how they could impact your bottom line if implemented in a timely manner.

1. Financial institutions need to regain lost ground as innovation with technology continues

For far too long, consumer perception has been that financial institutions are way behind other industries when it comes to technological innovation and process improvement. These increased consumer expectations were only further amplified by the pandemic, which led to a rise in self-service solutions across many industries. As a result, more consumers are expecting expanded self-service capabilities in all facets of life, including their banking.

ITM technology provides an exceptional opportunity for financial institutions like yours to position yourselves as innovators to your clients — which could be a key differentiator against your competitors as time goes on. This is particularly true given that the focus on improving digital and mobile banking solutions is further spotlighting the “innovation gap” between what your consumers may be able to access over the phone vs. what they are able to accomplish at a local branch.

Adoption of ITM solutions can empower financial institutions to undergo radical branch transformations that close this gap — while also keeping operational costs at beneficial levels (more on that in later sections) — by providing the next generation self-service technology consumers seek.

2. The “Amazon Effect” and its acceleration of on-demand consumer expectations

In late 2016, Amazon made its first Prime Air drone delivery. It only took 13 minutes from the moment the customer placed their order online for that package to arrive safely and securely on their doorstep.

Then in 2018, Amazon opened its first completely self-service grocery story, which offers customers a completely checkout-free shopping experience. In a few taps, and without the hassle of traditional “self-checkout” solutions most find at local grocery stores, Amazon customers can breeze through the store in a manner that is totally convenient for them.

Leaving aside these advancements, think about how Amazon has likely not only impacted your shopping habits, but also your expectations of how quickly and easily you should be able to have your needs met as a consumer.

- Do you find yourself frustrated if other retailers don’t offer similar overnight options?

- Are you annoyed when you can’t go to a local store, like Whole Foods with Amazon, to return items, so you don’t have to go to the post office to facilitate your own return?

This so-called “Amazon Effect” is continually transforming consumer expectations around convenience and raising the bar for service delivery across the board. And as we mentioned in the last section, this rise in consumer expectations has only expanded as the Millennial generation has entered their 40s, and Gen Z is now stepping into the beginning stages of their buying power. No longer do you need to go into a Target to do your shopping. You can place an order for everything you need on your phone, and then have it delivered to your car without you ever having to set a foot inside.

What does this mean for your financial institution? You can no longer expect clients to remain loyal if you continue to cling to archaic service delivery models and solutions. Today, consumers are far more willing to abandon ship from brands they once considered themselves loyal to, if there is too much friction or red tape present in the process. Patience may be a virtue still, but it is not one your consumers have too much of, thanks to recent world events, in combination with advancements in technology.

As a result, the old maxim that “consumers remember their last best experience” rings even more true today. For decades, the bar of consumer expectations has constantly been raised, where new innovations quickly become the standard, and it’s only accelerated in recent years. ITMs can help FIs bridge the innovation gap by leaving lasting, positive impressions on consumers that translate into increased satisfaction and positive word-of-mouth accolades.

3. Increased staffing challenges and rising operational costs for financial institutions

Prior to COVID-19, there were already clear efficiency discrepancies between the cost of an in-branch teller transaction vs. that of a self-service transaction. (Back then, the latter would present a cost savings of $4 per transaction, on average. Now that savings may be as high as $8 per transaction.)

Since the pandemic, however, the staffing challenge conversation for retail branch locations has shifted. The cost of staffing a retail branch location rose from $10-$12 per hour to $17-$20 per hour. What’s more, a $12 branch teller may have handled close to 5,000 to 10,000 branch transactions per month, per location.

Today, a $20 branch teller may be handling closer to only 2,000 to 5,000 transactions per month, per location — meaning you are paying more for less, as branch transaction volume has contracted.

Also, the size of the available experienced workforce to satisfy those positions has shrunk (as it has across many industries), making it much harder than it has been in the past to find the right talent to hire on staff. To further complicate matters, financial institutions have also struggled with the rise in costs to simply maintain their operations.

In addition to increases in consumer expectations, these challenges have forced many financial institutions to reevaluate their operations in significant ways — from how they look at staffing to how they approach the operations of their retail branch environments overall. This is where ITM solutions can come in as an attractive efficiency and cost reduction play that also rises to new consumer demands.

For example, ITMs (which offer 50% to 70% more enhanced self-service options than those found with ATMs) being implemented as part of a drive-through at a retail branch location can enable you to extend your hours, without having to pay for additional staffing to cover those new hours.

Or think about how your thinking may have shifted about when your clients will want to work with a teller for transactions. Prior to the COVID-19 pandemic, you might have thought consumers would resist the adoption of digital options. After the pandemic, however, through which your consumers were forced to go digital, that is no longer a primary concern. Particularly since more “digital native” generations (i.e., Millennials and Gen Z) now hold the majority of buying power. You may think of Millennials as a younger generation, but many of them are now entering their 40s.

Sure, your people may still be your differentiator, but your clients are less reliant upon them and actually prefer to have more self-service options at their fingertips.

4. The digital-first Millennial and Z generations are here

Global events, the “Amazon Effect,” and innovative trends that were already in motion in the banking industry are only further underscored by the consumer preferences strongly displayed by younger generations. Both Millennials and Gen Z consumers were raised as digital natives. Now, as adults, they have the built-in expectation of being able to complete (the vast majority of) transactions without having to speak with someone directly.

Although they may be very attached to their smartphones and other enabled devices, there is still the perceived convenience factor of having local branches available to them if they need assistance with a more complex transaction or customer service resolution that cannot be handled over the phone. In fact, industry experts don’t anticipate FI branches becoming obsolete anytime soon. In fact, 78% of consumers still use branches to make cash and check deposits, and 64% still use them to withdraw cash and/or cash checks.

However, the “innovation gap” we’ve discussed already will only appear more obvious to younger and rising consumers. Millennial and Gen Z consumers are more primed to see the disparity between a 5-star, self service-enabled digital experience through an app and the lack of translation of that experience to an in-person branch location.

This is your opportunity to rethink the in-person branch experience with streamlined operations and increased self-service options through innovative technology solutions such as ITMs.

Yes, there are clear indicators that ITMs can only serve to benefit the overall objectives of a forward-looking financial institution, as well as their bottom line. However, it’s important to weigh the pros and cons of ITM adoption to determine whether or not it is the right move for you. In this section, you’ll find the most common and influential factors you will want to consider as part of your decision-making process.

Pros of ITM adoption

1. Significant cost savings per transaction

As we discussed in the previous chapter, implementing self-service ITM solutions at retail branch locations can help offset the rising staffing costs and lower transaction volumes now associated with the modern realities of a modern financial institution in a post-pandemic environment. However, in addition to per transaction-savings related to staffing, there is an additional area of cost efficiencies that are addressed with the implementation of ITM technology — branch real estate.

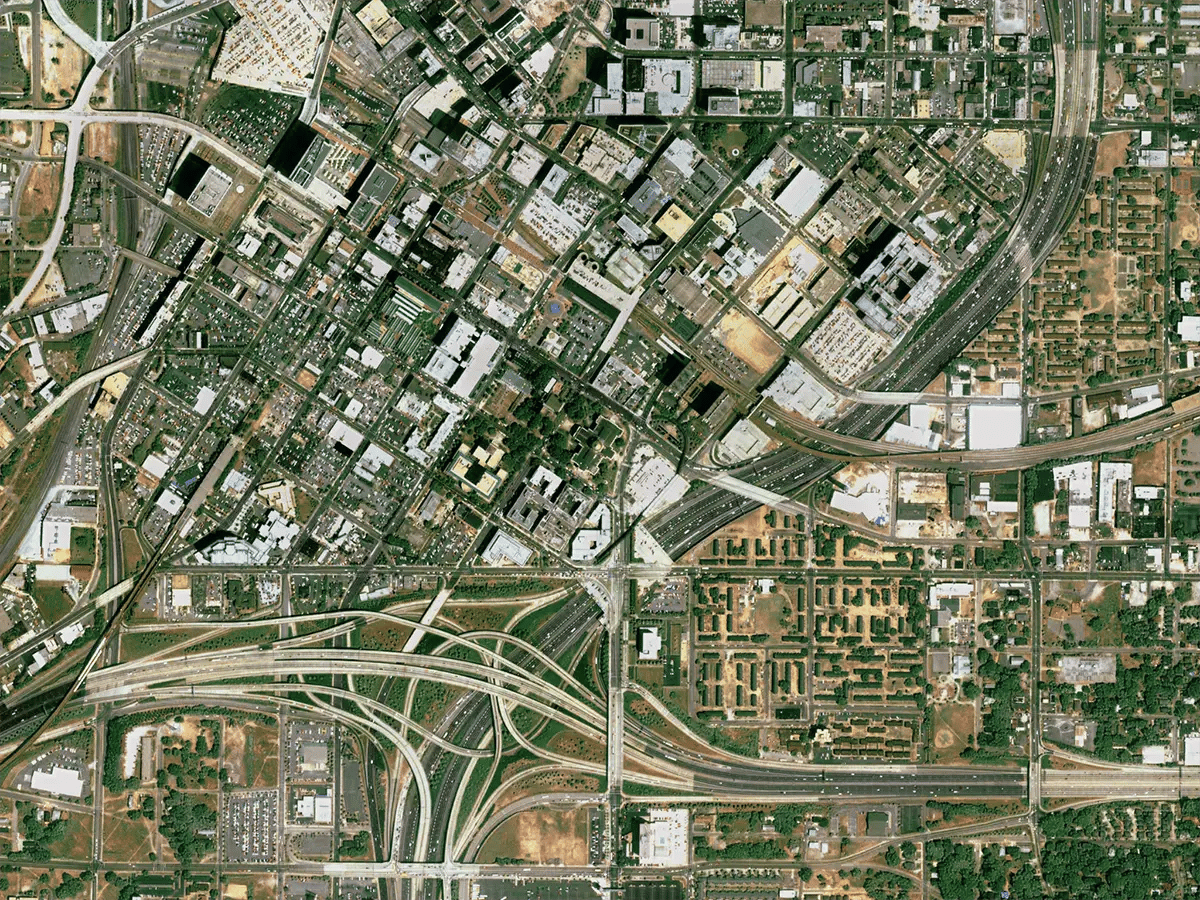

2. Branch real estate optimization

A meaningful majority of financial institution executive teams across the country are currently asking themselves the following questions:

- “Do we have the right physical locations? Do we have too much coverage in certain areas? Are we lacking critical representation in others to meet consumer demand?”

- “As the cost of real estate has continued to rise, are we maximizing the functionality of your branch footprints to the best of our capabilities?”

- “Are our branches too big? Could we reduce our footprint to 1,500 to 2,000 square feet?”

As cost-per-square-foot and interest rates continue to climb, the urgency of answering these questions has increased, as well. Real estate cost reduction is the key to success for today’s financial institutions, which is why we’re seeing branches that may have been built out at 5,000 square feet in the past scaled down to 1,500 to 3,000 square feet.

Self-service ITM technology is a powerful strategic investment, as it empowers financial institutions to offer the robust, progressive, innovative experiences consumers are demanding within smaller footprints. This offers you the ability to scale down real estate investments while thoughtfully expanding and modernizing what capabilities you can offer to branch consumers.

Many financial institutions we work with are undergoing a branch rationalization initiative. As part of that work, a large percentage have been leveraging a leave-behind strategy, wherein they are using ITM technology to service the area to reduce runoff in deposits that could be associated with closing a branch location entirely.

In short, ITMs provide you with the ultimate ability to do more with less with your branch real estate footprint — an absolutely essential win in today’s banking environment.

3. Restructuring banking fees for consumers

On top of rising staffing and real estate cost challenges, banking institutions such as yours have had to work through the added pressures of radically upending your banking fee structures. For example, recent years have been marked by increased, headline-grabbing scrutiny of overdraft fees by consumers, which have prompted a large number of financial institutions to do away with them entirely.

Should evolutions in how we do business as banking and financial institutions be embraced? Absolutely, change is healthy and should be anticipated in any industry. That said, many of these forced fee reductions and eliminations for consumers have been pushed forward by individuals and groups who do not understand the business of banking. As a result, financial institutions such as yours are left to solve these additional revenue shortfalls, on top of the other challenges you are already facing.

Again, this is where ITM technology investments can be a wise move, as they provide cost efficiency opportunities across multiple categories, while also enabling you to evolve in meaningful, innovative ways.

4. Increased operational efficiency and revenue growth

💡 An estimated 80 to 90% of transactions typically done by a teller at a branch can be handled by ITMs.

These include cash and multi-check deposits (to multiple accounts), loan payments, mixed-denominational withdrawals and check cashing down to the penny. With the right integration, ITMs can help you seamlessly shift traditional transactions from the teller line to self-service.

Not only can this shift result in significant cost savings over time, it can free up your team members to build deeper relationships with your clients, gain a better understanding of their needs and make strategic product recommendations. We refer to this as moving from “transactions” to “interactions.”

5. Unparalleled convenience that’s a win-win for everyone

We’ve already touched upon this in abstract ways, but the benefits of convenience afforded to you by ITMs is something that must be underscored on its own. Thanks to their robust self-service capabilities, ITMs help you deliver a more flexible branch experience to your clients. Customers or members no longer have to rush to your branch at peak times, risking long lines in the lobby or at the drive-thru just to cash a paycheck or make a loan payment.

With an ITM, you can extend your hours for 80 to 90% of traditional teller transactions without actually having a teller on site. And if your client needs after-hours assistance, the ITM live video feature allows for remote teller support during the transaction. That makes ITM technology a win-win for both you, the financial institution, and your consumers.

Detaching from the Branch

Unmatched Flexibility in Your ITM Placement Strategy

ITM technology allows you to detach your self-service channel from the physical branch. The benefits to your financial institution are twofold — you will possess increased flexibility as an institution, while also being able to provide expanded services and convenience for your consumers.

Bypassing pneumatic tube systems

For decades, pneumatic tube systems have been a staple of financial institution branches. However, even at the peak of their popularity, they have always presented numerous challenges — cost, maintenance, efficiency, physical proximity locations, and so on. (And these challenges have only become more glaring as technology has continued to evolve and consumer expectations have significantly become more modern.)

For instance, the average tube transaction ranges between 5 and 6 minutes, whereas the average video transaction is 50% shorter, ranging between 2 and 3 minutes. Of course, this is assuming the tube transaction in question only requires a single exchange — if multiple exchanges are required through the tube system, the length of time required for a transaction can easily double or triple.

ITMs are an ideal solution for financial institutions to embrace, in place of the more outdated pneumatic tube model. The transactions are much faster, which increases consumer satisfaction and retention, as well as your operational efficiency. You also can alleviate staffing pressures; instead of having to have dedicated staffing that is working the tubes, you can centralize or not have any teller presence at all to execute those ITM transactions.

There are also benefits from a facilities and maintenance perspective. In addition to reduced maintenance requirements, you may need fewer lanes with the installation of ITMs. We’ve seen clients take advantage of this by creating wider drive-thru lanes.

Boost accessibility with a branch-like ITM

Branches in busy or congested areas can often experience accessibility issues at peak traffic times, such as morning and evening rush hours. This can be a deterrent for clients who desire to use the branch but have trouble accessing its location during certain parts of the day. So, how can you leverage ITMs to address this challenge?

One strategy for branches in this situation would be to place standalone ITM units close to the main branch but in a location more easily accessible during peak traffic hours.

These ITM units can be highly branded, almost giving a branch-like feel, yet are fully serviceable via remote tellers, giving clients the teller access without having to navigate traffic flowing into the branch.

Using our current estimates, you could deploy 15 to 20 freestanding ITMs that offer this branch-like experience in a decentralized manner for the cost of a single branch. This is a powerful advantage as consumers still prioritize physical presence as a significant ranking factor in choosing a financial institution. You can create a competitive advantage by meeting this need with freestanding ITMs, which enable you to create a “convenience density of touchpoints” without opening new branches.

6. Competitive advantage through innovation

In decades past, the cost of resisting such innovations wasn’t as steep. Today, however, a failure to embrace the innovations your clients are now expecting as the norm will decrease your operational advantages. This is further highlighted by the fact that both Millennials and Gen Z consumers prioritize innovation and convenience with brands, while also demonstrating lower degrees of brand loyalty than previous generations.

Additionally, this strategy of free-standing ITMs is a cost-effective way to serve LMI consumers in your geographic footprint.

Now, for progressive financial institutions who are willing to invest in innovations such as ITMs, the competitive advantage can be significant. Those that successfully implement ITMs across their footprint can gain a competitive advantage over slower adopters by positioning themselves as innovators in the financial space.

7. Grow effectively, efficiently increase market presence

We’ve already discussed how ITMs empower financial institutions such as yours to move 80 to 90% of traditional transactions to self-service. While this presents obvious operational efficiencies, this shift also means you can expand your FI’s market presence without having to open another branch. From malls to college campuses to targeted residential areas, ITMs can be strategically placed in a very cost-effective way to increase your market footprint.

8. Increased security with ITM technology

Another benefit that should not be overlooked with ITMs is how they can increase your security by minimizing your cash exposure.

Moving to a virtual teller model where more tellers are located off-site can greatly reduce the number of staff accessible at the branch to be robbed. ITMs can also help drastically reduce the number of places you’re keeping physical cash in the branch (i.e. teller drawers), meaning staff are handling cash less often. It also means that the cash, for the most part, is locked away in secure devices.

9. Cash recycling

Hyosung (which we discuss in greater detail later in this guide) has taken the market leader position with north of 15,000 cash recycling terminals in the United States. Why does this matter? We aim to limit the number of times an ITM is loaded, by limiting the number of interactions staff members or an armored car has to have with the machine.

Armored cars on their own also present numerous challenges to financial institutions — e.g., straps left on money when loaded, money loaded incorrectly (leaving it down and out of service), the hassle of having to deal with another third-party vendor, and so on. Cash recycling eliminates one, if not two of those trips in a month to offset cost and provide greater uptime. In addition, cash recycling also allows for larger amounts of note deposits.

Overall, we feel that cash recycling can bring in a new segment of consumers for financial institutions. For instance, a small business or boutique that can leverage a self-service ITM to buy change.

Cons of ITM adoption

1. High cost of entry

Yes, ITMs are more expensive than ATMs. Additionally, new ITM units can require a significant upfront capital investment, which may not make sense if you’re currently looking only to invest in one or two units — you may need to purchase multiple units to truly see the benefits of scale.

There are also infrastructure costs beyond the equipment purchase to take into consideration. These include network upgrades to provide the necessary bandwidth for high-resolution video integration, as well as setting up a call center to provide remote teller assistance. Again, these cost considerations can be of greater significance if you’re only in the market currently for between one and three units.

2. Staffing models can be challenging to navigate

The extended hours created by an ITM also create the need for expanded staff support. If your FI is accustomed to staffing branches from 9 a.m. to 5 p.m., Monday through Friday, the integration of an ITM may require you to staff additional hours for the remote video teller feature. Additionally, you’ll have to navigate peak times at the branch when your clients choose self-service over a traditional teller. Instead of adding more in-person staff to the teller line, you may now be required to add more remote tellers at your call center.

3. Video integration can extend transaction time

No doubt about it, the use of video through an ITM brings with it the potential for longer transaction times. Depending on the ITM solution you select and the integration environment, a video teller may be required even for very basic transactions. (Because of this, we’ve seen clients lean more heavily toward core integration than video teller infrastructure.)

This means that even a client using an ITM to deposit a check and get $20 in cash back is interacting with a remote video teller to do so. If video tellers aren’t available at that moment, the client is left sitting at the machine waiting for assistance.

4. Core integration

By having a device integrated to your core, you’re able to offer more transactions into self-service. Currently, not all ITM solutions offer across-the-board core integration. If you’re on a smaller platform, it could take time for your core system to write an integration to the device. Additionally, as you think about direct-to-core versus off-core/dual-entry transactions, end-of-day settlement for the device can become a challenge.

💡Insider Tip: Assess Your Core Agreements

If your core agreement is up in the next two years or less, be sure to address ITM core integration as part of the renewal. Before you’re willing to renew with a core solution for another five years, your provider needs to be committed to delivering integration functionally by a certain timeframe as a part of the agreement.

Since the introduction of ITMs, two manufacturers have emerged as the market leaders in ITM technology: Hyosung and NCR. In recent years, however, the tides have turned, regarding which of those two leaders strike the right balance of technological innovation, support, and cost efficiency.

HYOSUNG

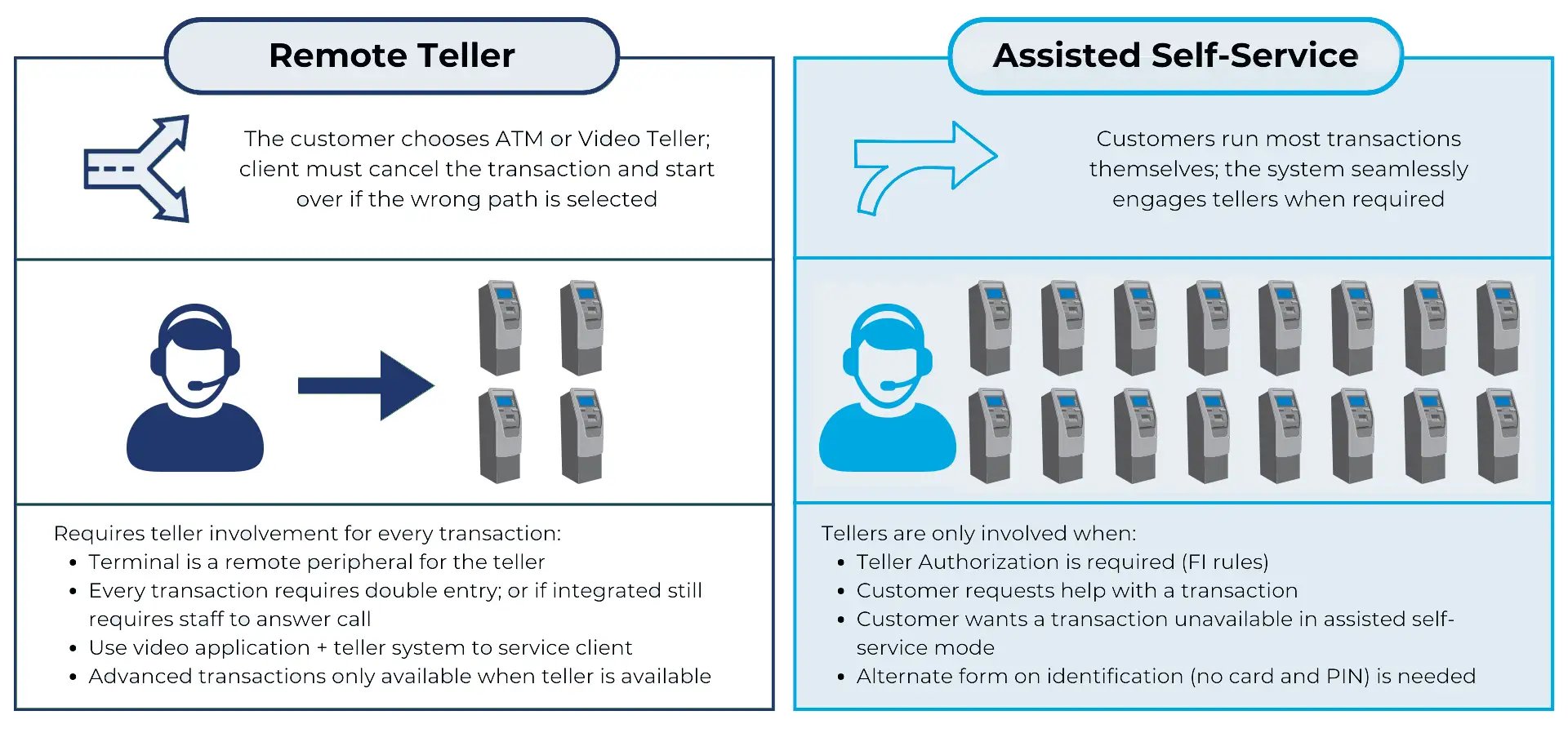

Texas-based Nautilus Hyosung America (Hyosung) entered the North American market in 1998 and has positioned itself as the largest and fastest growing ATM provider in the U.S. Hyosung’s go-to-market strategy for ITM technology – which it brands as New Branch Solution (NBS) – is best summarized as “self-service transactions with video assistance as needed.”

Today, 13 of the top 15 financial institutions in the country are Hyosung customers. Their approach utilizes core integration and ATM rail integration to allow a much richer transaction set to be accomplished by the customer or member without the interaction of a teller. (To date, they have approximately 20 cores complete — of the 25 to 30 in the market — which is a significant amount of coverage based on the number of cores available.) Transactions that can’t be done through either the core or ATM rail integration would require teller assistance.

One example might be an individual cashing a check that’s drawn on that institution, but the individual is not a customer or member of that institution. In a lobby environment, exceptions like these would typically go to a tablet, allowing a teller to walk up and provide face-to-face assistance at the ITM. In a drive-thru environment, a video teller working from either inside the branch or at a remote location (call/operations center) would provide the assistance on screen.

Hyosung has excelled in taking the approach of doing as much in self-service as possible. As noted, yes, they have teller and tablet assistance options available, but they are not typically the primary method by which people deploy the technology.

With Hyosung’s core and ATM rail integration strategy, 95% of the traditional transactions can be done through the ITM without requiring video teller assistance. These include withdrawals of multiple denominations down to the penny, cash and check deposits, split deposits into multiple accounts, and check cashing down to the penny.

The core integration aspect also allows for payment transactions, which is typically not part of the ATM world. With that capability, clients can make payments on their home equity line or auto loan; they can even make a credit card payment if the card is from that FI and attached to the core.

Hyosung’s vision for the ITM is to drive efficiency at the branch by migrating typical teller transactions to self-service through core and ATM integration. This helps position branch staff to focus more on relationship building than transaction processing.

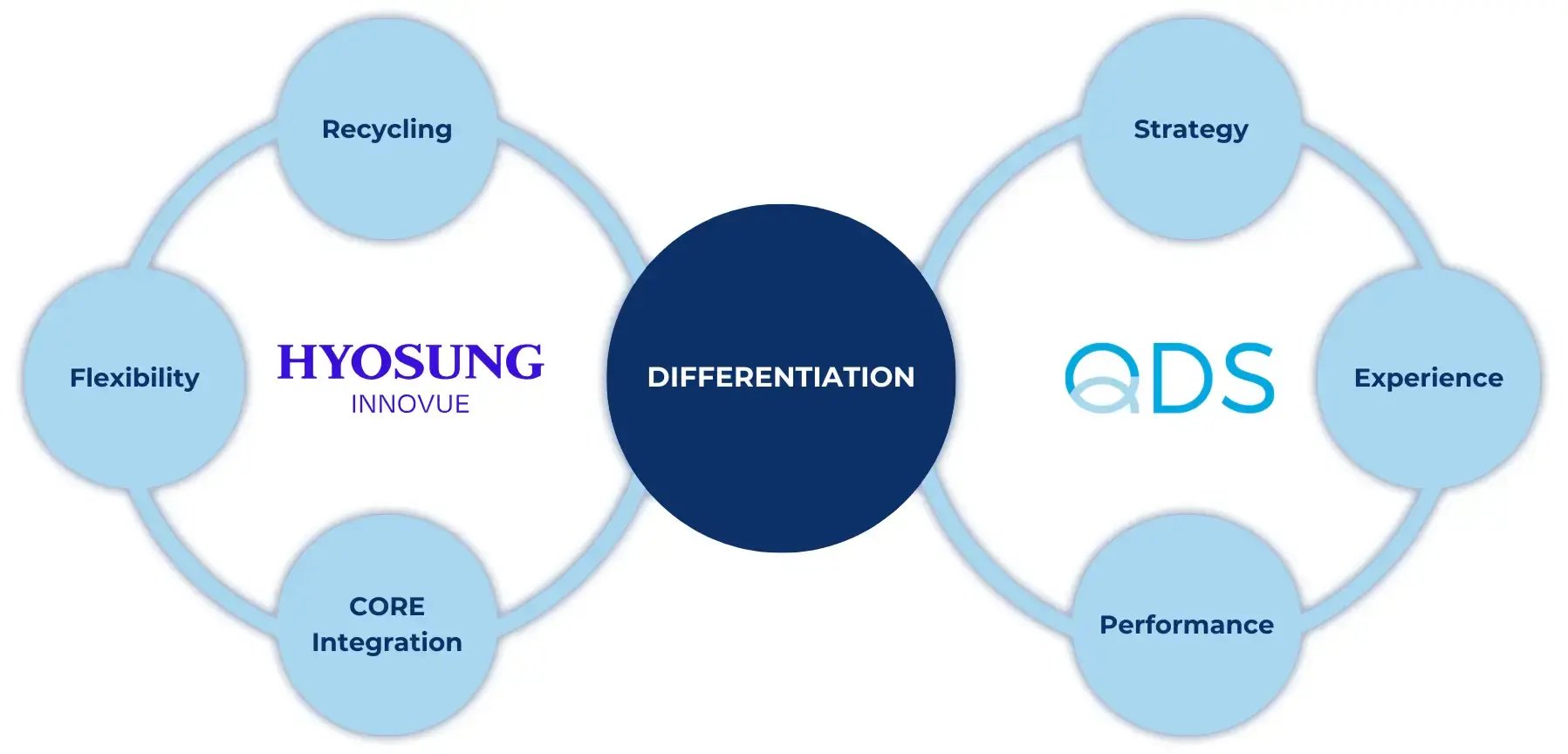

Why We Recommend Hyosung

To be radically transparent, we at QDS strongly recommend Hyosung to our clients due to their reliability, innovation, and unparalleled support. Whereas competitors such as NCR and Diebold have outsourced their manufacturing, Hyosung has kept their manufacturing in-house, which provides all customers with a more reliable product.

Our philosophy at QDS is we want you to spend the right money on the cash automation technology you need, not the most money. Hyosung empowers us to deliver on that promise with ITM product lines that offer immense flexibility to your financial institution.

💡Did You Know?

With Hyosung, 95% of the traditional transactions can be done through the ITM without requiring video teller assistance.

NCR

From its start as The National Cash Register Company in the late 1880s, Atlanta-based NCR has become a global leader in omni-channel solutions, enabling nearly 700 million transactions daily across the retail, financial, travel, hospitality, telecom and technology industries. That said, NCR has increased its perception in some circles as a riskier investment overall, due to changes in its structure as a business.

A few years ago, NCR put itself up for sale, but they were unable to secure a buyer. Since restructuring was still an absolute necessity, NCR split itself into two entities — NCR Atleos (ATM and ITMs) and NCR Voyix (Retail POS software and Professional Services) — resulting in changes to support. There is speculation that this move is still designed to prime the market for a sale of both entities, which is why industry insiders have reduced confidence in NCR as an investment over the next five to 10 years.

These shifts within NCR have had meaningful downstream implications financial institutions will want to consider, especially those of you who are considering ITM technology as part of your future strategy.

Still, NCR does possess a well-earned brand cache from their years as a leader in ATM and, later on, ITM technology. In fact, they are still a market leader with a broader pool of customers than Hyosung, which should not be overlooked.

From an ITM-perspective, NCR’s focus has primarily been on the face-to-face client-teller interaction and how to centralize that function. Their solutions allow FIs to essentially “outsource” the traditional teller function, almost to the point that true branch transformation means an FI’s tellers can be centralized in a remote location. Branch-based staff can then focus on client interaction and revenue generation.

Another value proposition for NCR’s ITM market strategy is the ability to extend branch hours without requiring on-site staff. Through NCR’s Interactive Teller platform, customers or members can interface with a live person and conduct teller-assisted transactions outside of traditional branch hours, typically 9 a.m. to 5 p.m. Extended hours for teller-assisted transactions present a unique competitive advantage in the market for FIs, translating to tremendous growth potential.

However, NCR’s potential over-reliance on video teller transactions — which enabled them to sell to more customers faster, establishing them as the market leader — as opposed to prioritizing core integration the way Hyosung has, is something to consider.

Hyosung vs. NCR: a head-to-head comparison

| Hyosung + QDS | NCR | |

|---|---|---|

Staffing |

1 Video Teller, 15 to 25 machines |

1 Video Teller, 2 to 4 machines |

Infrastructure Cost |

Up to $80,000 for server + server setup |

Up to $150,000 for server + server setup |

Monthly Networking Cost, Bandwidth Usage |

$ |

$$$ |

Models Available |

10+ |

4-5 |

Cash Recycling |

10,000+ cash recycling units in the U.S. |

Still no cash recycling solutions are available at this time. |

Transactions |

95-99% in self-service, 1-5% video teller services |

50% in self-service, 50% video teller service |

Hyosung vs. NCR pricing

| Hyosung + QDS | NCR | |

|---|---|---|

ITM Hardware Cost |

$50,000 - $80,000 |

$55,000 - $70,000 |

Upfront Cost Per Institution |

$80,000 - $130,000 |

$150,000 - $350,000 |

Annual Software Fees Per Terminal |

$4,500 - $7,000 |

$6,000 - $9,000 |

Maintenance + Managed Services |

$6,000 - $7,000 |

$7,000 - $9,000 |

Staffing Cost |

1 FTE Per 20 Terminals |

1 FTE Per 3 Terminals |

Hyosung vs. NCR: Final Thoughts

With two very different go-to-market approaches, both Hyosung and NCR have shaped the ITM landscape with a wide range of innovative solutions. Hyosung’s strategy is driving more self-service transactions so staff members can focus more on engagement than transaction processing.

NCR’s strategy is maintaining the face-to-face interaction between teller and client but, through centralizing the teller function, FIs can eventually achieve desired scale, as teller staffing is throttled up or down to meet client volume. A centralized teller environment can also help mitigate unexpected staff absences. This issue especially impacts FIs with branches spread across a wide geographic footprint.

For example, in many rural areas, a teller calling out on short notice can be very difficult to backfill, but this scenario is solved with a centralized teller structure. Another distinction between the two providers is their approach to the self-service transaction set. NCR’s 80 Series units offer ATM functionality with the ability for clients to talk to a teller for anything that’s not an ATM transaction.

Hyosung’s solutions, however, in a core-integrated environment can provide eight to 10 key transactions that clients can do completely self-service, and the ATM functionality is more for noncustomers/non-members. The driver for teller assistance is then either a business rule violation or a transaction that falls outside of those eight to 10 core functionalities.

Finally, it’s critical to keep in mind how NCR’s position in the market has changed. At one point, you could have considered NCR the leading innovator in ITMs, and you would not have been incorrect in that assertion. That said, NCR has not moved their ITM solutions very far forward in the past 10 years — in fact, as Hyosung continues to move ahead, NCR’s innovative posture has weakened. The banking technology curve has shifted, and NCR has not effectively kept pace.

Why does this matter? Our industry is moving rapidly in the direction of self-service and core integration, areas in which Hyosung is clearly now establishing itself as the true innovation leader for ITMs. Yes, NCR was the original innovator, but Hyosung’s strengths are difficult to ignore given those trends.

A Note About Diebold Nixdorf

Yes, Diebold Nixdorf offers an ITM solution, which has seen limited installs in a few larger banks; however, software challenges have prevented their solution from a broader market rollout. Also, similar to NCR, Diebold has also had to undertake significant restructuring as a brand to maintain solvency. Today, QDS still doesn’t see Diebold Nixdorf as a viable player in the ITM space moving forward, as they continue to implement cost-cutting measures to ensure profitability.

From increasing cost efficiencies and elevating the consumer experience, to expanding market presence and alleviating staffing challenges, we’ve seen first-hand how ITMs can have a measurable, positive impact on the bottom lines of forward-thinking financial institutions. What follows is a real-world success story, plus other results from community financial institutions.

The Five Star Credit Union Story

Five Star by the Numbers

Five Star Credit Union | Dothan, Alabama

- $750 million in assets; soon to be $1.2 billion at the completion of 2 bank acquisitions

- 17 branches

- 130 employees (70 are branch staff)

- Branch network rural Alabama and Georgia

- Low income, blue-collar membership

- Jack Henry Symitar core

- Installed 40 Hyosung core integrated ITMs

- Entire fleet supported by 2 staff members

ITM Implementation Results

- 40 ITMs conduct 65,000+ transactions per month (70% of all branch transactions)

- 99% of ITM transactions are done via self-service

- 70-75% of transactions performed on drive-through ITMs

- Active teller handles 1.3% of the transactions

- Members migrating from traditional branches to new technology branches

- Members requesting ITMs for traditional branches

- Staff can focus on problem resolution and onboarding

💡 More Real-World ITM Results

Institution A

-

96,000 transactions run 45 units

-

Only 608 needed video teller assistance

-

Entire fleet supported by 1.5 video tellers

Institution B

-

130,000 transactions run 40+ units

-

Only 5,000 needed video teller assistance

-

Entire fleet supported by 3 video tellers

Given the strategy and cost considerations associated with an ITM implementation, you may be asking yourself: “Is our financial institution ready to make the kind of investment that ITMs bring from a capital expenditures standpoint, or do we prefer to prepare ourselves to add that functionality later?”

Both Hyosung and NCR offer ATMs that can also be ITM-ready at any point, allowing FIs to future-proof their ATM fleet. But is this investment right for your FI? Let’s examine some of the reasons why this might be the right approach for you.

ATM Replacement

Perhaps there are a handful of units in your ATM fleet in serious need of replacement, or maybe you’re looking to replace the entire fleet altogether. You have researched the pros and cons of implementing ITMs and have identified the infrastructure you’ll need in place to support ITM implementation. After all that, you’ve concluded that your organization is probably one to three years away from ITM adoption.

The challenge is that you have to make a purchase decision now for the ATMs needing replacement, while also looking ahead to what you’ll need in future. Considering an ITM-ready ATM could certainly make sense for you. You would be investing in hardware that both meets the immediate while positioning you for success down the road.

Instead of having to replace ATM units again when you’re ready for ITM implementation, you would just need to engage the ITM-features on your current ATMs. With ITM-ready units already functioning across your fleet, you’ll save significant time, energy and capital by not having to repeat the buying process at a later point.

Expansion Strategy

Currently, we estimate that you can implement between 15 and 20 free-standing ITMs for the cost of a single branch. If you’re looking to expand your market presence in a way that makes sense from a cost perspective, ITMs can position you well with your expansion strategy. ITMs can help lead that charge before you ever consider a brick and mortar presence in a new market — or expanding into an existing service area.

For example, let’s say you’ve identified a piece of property on the southside of town, and preliminary market research indicates that this is the best spot for your newest branch. Before committing to a full-scale branch operation there, you could consider a self-service, canopied presence using a mix of ATMs and ITMs.

At the same time, you decide to test some other part of town you’re considering for a new branch with the same strategy – all at a lower cost than opening the one southside branch. This approach to growth allows you to really understand where the volume demand is, what makes sense for a self-service presence, and where it makes sense to open a full branch operation. When you have ITM-ready ATMs in your fleet as a part of this strategy, you can conduct a richer test of your clients’ needs as you expand.

Perhaps you find that the client base in the southside of town is the ideal adopter of ITM technology. With two to three ITM-ready ATMs already installed at that location, you’re able to flip the switch and provide a full ITM presence there to meet that demand.

How Ready Are You for ITM Implementation?

While you can purchase both ITM-prep or ITM-upgradeable hardware from both Hyosung and NCR, some FIs may be concerned about what that upgrade will cost at a later point:

Is it better to go ahead and buy it all in the box from the factory?

If you’re at least 75% sure that you’ll implement your ITM strategy in the next 12-24 months, it would behoove you to go ahead and buy it with the full gear. If you like the ITM concept but are maybe 50% sure (or below) on whether or not it’s the right strategy for you, perhaps the convertible/upgradable option would be a better way to spend that money to at least know that you’re future ready.

Again, if you’re confident that you’ll be implementing in 12-24 months, it makes sense to buy ITM-ready or fully-loaded hardware. That way you can budget for the back-end costs in a year’s time.

There is a huge strategic component to this technology as a part of a branch transformation and growth initiative. As you go down this path, it’s important to understand all of the solutions in play, what their strengths are, and how an ITM strategy can help you grow as a financial institution.

By partnering with a thought leader like QDS to help define your success criteria and how you want to impact your business, you’ll better position your organization for ITM success. In addition to serving FIs as an ITM expert, QDS offers a variety of ways to help institutions grow from remote cash capture to cash automation to commercial deposit processing. Our holistic approach extends far beyond understanding the latest technology in the market.

We spend time learning your goals, opportunities and challenges as an organization, and then develop customized solutions to accelerate your mission.

The QDS Difference

In addition to our uptime guarantee for all of our ATM and ITM managed services customers, you will benefit from our strong relationship with Hyosung’s executive team. QDS has invested heavily in internal project management and professional services resources to ensure your ITM implementation project goes well, and we can be the most responsive company to your needs.

“We are here to be a light in a dark market, to do good for those we are lucky to serve. We are dedicated to excellence in everything we do, so that our customers are successful. Because, ultimately, it is their success that matters more than anything.”

– Sean Farrell