.jpg?width=2407&name=CLECU-(sized).jpg)

Calhoun Liberty Employees Credit Union in Blountstown, Florida is introducing their first ITMs to the market. With plans to offer greater service to members across their key counties, ITMs allow greater functionality and extended hours. We look forward to working with the CLECU team!

.jpg?width=2407&name=United-Community-Bank-(resized).jpg)

All In Credit Union in Daleville, Alabama has taken the opportunity to automate their drive-thrus to improve member experience. They have committed to implementing Hyosung 8300 ITMs. In the remaining months of 2021, QDS will be installing 17 of these units, all with attention-grabbing custom wraps designed specifically for All In's machines.

In the August 2021 edition of the QDS Newsletter, CEO Sean Farrell shares success stories of QDS' continued growth as well as market trends surrounding digital and video banking, opportunities to visit the Hyosung Client Experience Center, and a special offer on Glory RBG Teller Cash Recyclers (TCRs.)

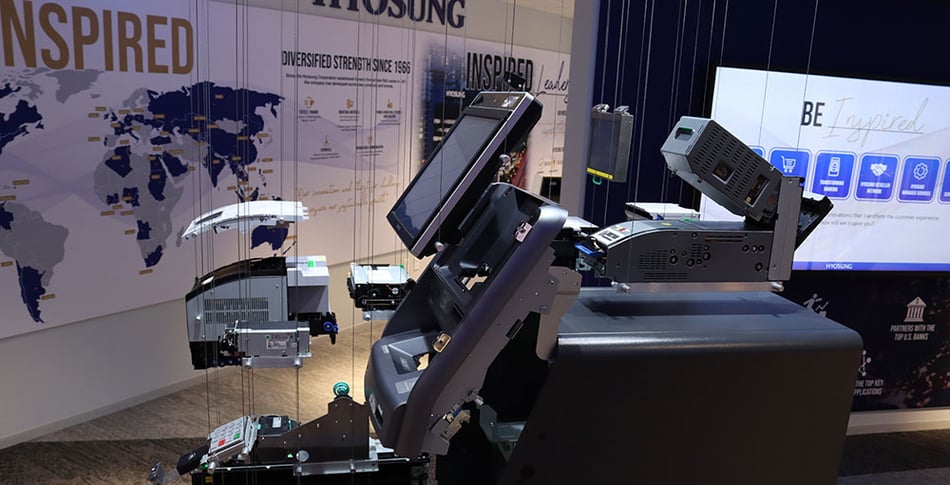

In 2020, Hyosung has moved their corporate headquarters to a building in Dallas, Texas and launched their state of the art Customer Experience Center (CXC.) Many QDS clients are now scheduling in-person tours of the facility. These tours allow representatives to gain hands-on knowledge and experience of Hyosung solutions as well as strategize current and future banking at their institutions.

Community South Credit Union in Chipley, Florida has partnered with QDS to implement Hyosung 8300 ITMs across 4 branch locations. They partnered with QDS based on the company's exceptional service reputation as well as the team's expertise about the ITM solution.

“We look forward to enhancing ways our members can interact with us and offer greater functionality across more hours to make ourselves very convenient to do business with. Sean and the QDS Team have been great to work with, and help us navigate how to implement this technology well.”

— Jan Page, Community South Credit Union President/CEO

.jpg?width=2407&name=Wayne-County-TCR-Install-(resized).jpg)

The Bank of Wayne County in Waynesboro, Tennessee has taken their first steps into cash automation! In choosing QDS as their TCR provider, they have implemented Hyosung MS500 Teller Cash Recyclers to increase transaction speeds and overall efficiency.

Here at QDS, we want to offer you the best branding solutions to better build and highlight your FI's brand identity. With solutions like graphic screens for ATM and ITM machines, accessories for your ATM/ITM fleet (like wraps, canopies, toppers, and LED surrounds.) Read more about how QDS can take your FI's branding to the next level!

In the May 2021 edition of the QDS Newsletter, CEO Sean Farrell summarizes our POPiO Video Banking Webinar and discusses QDS' continued growth, mergers and acquisitions within the southeast market, and 2021 market trends your FI should consider in during the upcoming months.

In today's financial market, physically entering financial institutions has become a challenge. The COVID-19 pandemic has increased capacity regulations and consumers' preference for virtual, on-demand service. FIs have struggled to effectively serve their clients in today's banking environment. Video Banking is a solution for these challenges and more!

The interactive webinar will address:

In the April edition of the QDS newsletter, we discuss the latest in video banking technology and why it's an ideal tool to provide to your clients for remote, on-demand service. See how TCRs can improve your FI's operations and overall client experience. New Blog; Why Your Head Teller Needs a TCR.

In the October edition of the QDS newsletter Sean Farrell, CEO of QDS, discusses current market trends accelerated by the COVID-19 pandemic. In our COVID Catalyst series, we discuss how COVID-19 has reshaped the financial industry and what technologies are at the forefront of the market. Learn more about how ITMs have become essential in today's banking environment and about the technology's cash recycling capabilities. New Blogs; CashIntegrity vs. Armored Car & Five Key Benefits to Remote Cash Capture.

With consumer expectations and banking operations forever changed, the value of expanding self-service capabilities beyond basic ATM functionality is of strategic interest to many institutions. Whether you’re on the fence or just wanting to learn more, we encourage you to watch this webinar recording.

The interactive webinar will address:

COVID-19’s impact has reshaped the financial industry for financial institutions and their clients. Now more than ever, consumers expect instant, on-demand service across all industries. Automation technology such as ITMs and TCRs, remote cash-capture, and digital banking solutions like POPiO are now key tools in delivering to these clients and keeping them satisfied.

FIs cannot expect to go back to conducting business as they did before. Consumers will expect the convenience and immediacy of automated and self-service solutions beyond the year of 2020. Financial institutions will have to adapt to this altered market. While these investments may seem lofty now, the price of ignoring them and suffering financially down the line could be far more costly. As your FI moves forward, consider how adopting this technology might serve your clients in the upcoming years.

In the September edition of the QDS newsletter Sean Farrell, CEO of QDS, discusses Video Banking with POPiO! QDS partners with All In Credit Union for integrated ITMs, and MidSouth Bank with ATMs! Review the Hyosung Tool Kit; 8300 Series, NBS Software Webinar, and Deposit Automation Promo! LEVEL5 ReFi program, redefining branch transformation. New Blogs; QDS Managed Services: Remote Service You Can Trust, and Urban vs Rural Banking.

Recently, the executive team decided to partner with QDS in positioning Hyosung’s 8300 series of ITMs in their drive-thrus to enhance the member experience. Being able to leverage connection to the CORE and deliver their members the largest functionality available over a 24/7 banking experience was paramount in the decision to explore the technology.

“At All In Credit Union, we are passionate about the member experience. It’s the primary reason we search for new technology to help us deliver consistent, high-quality experiences for our members. Because of our commitment to excellence, we look forward to relying on the advice from our partners at QDS to offer Hyosung technology. This technology will offer enhanced functionality and convenience for all our members, allowing them to bank when and where they want.” – Ben Bradley, VP, All In Credit Union

.png?width=770&name=News%20Web%20image%20-%20Aug%20newsletter%20(1).png)

In the August edition of the QDS newsletter Sean Farrell, CEO of QDS, discusses Anti-Microbial Solutions in the ATM channels from Hyosung, along with a recording of the latest NBS webinar from QDS. Level5 Leverages Technology Expertise of QDS in the Re-Fi program. Three Banks in Pensacola choose QDS for ATM Outsourcing. Two new blogs launched this month as well; How Cash Discriminators Can Improve TCR Performance and Top Four Reasons Your ITMs Should Recycle.

Alabama ONE CU, based in Tuscaloosa, AL, and Quality Data Systems, Inc. (QDS) out of Charlotte, NC, have partnered together for an ITM roll out over the next 3 years.

Alabama ONE’s progressive leadership team saw the value in integrating units to their core systems, Corelation’s Keystone, and also the value of cash recycling providing in Hyosung’s 8300 series of ATMs and ITMs. The CU plans to improve drive-through efficiency as well as adding lobby self-service to drive enhanced member experiences and functionality.

“Our team simply loved how QDS does business. It’s refreshing to have a vendor truly lookout for your interests and help make the right decisions to advance our CU. We are excited to implement the new ITM technology from Hyosung to advance our member experience and help them achieve their financial goals.” – Myke Brown, Director of Retail Operations

Alabama ONE will be focused on Hyosung’s 8300 series of ITMS, pairing core connectivity, video teller assistance when needed, and lobby self-service devices to quickly handle traditional transactions. The model will allow Alabama ONE to focus its staff on member interaction, education, and ultimately guide their membership to financial success.

Five Star Credit Union, based in Dothan, AL, continues to strengthen its relationship with QDS, Inc by increasing the number of Interactive Teller Machines (ITMs) it offers members.

In 2019, Five Star installed 12 ITMs in three new branches. The adoption of the ITM technology has been much more successful than Five Star expected.

After the successful first round of ITM purchases, Five Star has ordered an additional nine ITMs to begin converting legacy ATMs into ITM functionality.

The new ITMs will include cash recycling as a feature allowing for greater cash deposits, less frequent loading/unloading, and reduced staff time spent maintaining the machine.

“Our members took to the ITM concept right away,” said Tyler Beck, chief operating officer at Five Star Credit Union. “All of our branches with the ITM technology saw transaction rates increase with very little pushback.

We can offer extended hours, Saturday hours, and let our members know they can access their accounts 24 hours a day. This frees up staff to help members open accounts, begin the loan process, and solve problems.”

Five Star Credit Union is looking to install the new Hyosung 8300 series ITMs in the third and fourth quarter of 2020. They have become a leader in ITM technology in Alabama and the QDS family.

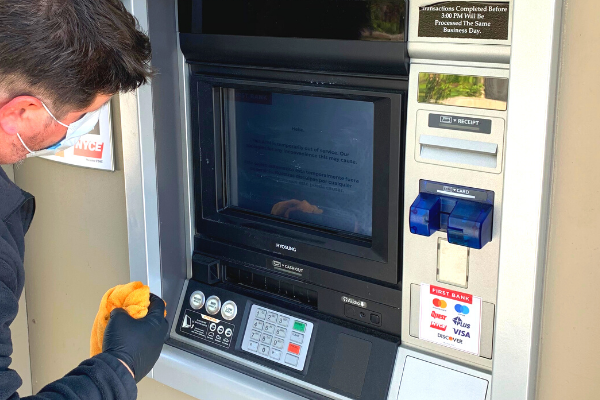

(Charlotte, NC, October 16, 2018) Southern Pines based First Bank has signed an agreement with QDS to replace their entire Diebold ATM fleet with Hyosung ATMs. The move sets the bank up for compliance with Windows 10 and enables new managed service technology to deliver maximum uptime to First Bank customers. By adding some devices with key future technologies, the bank is positioned to offer new services at key locations, while maintaining high availability to all locations.

We have evaluated the pros and cons of ITMs in the download. If you would like to dive deeper into ITMs click here for our ITM Buying Guide.

It you have not yet decided whether ATMs or ITMs are right for you than click here for that full comparison.

Simply fill out the form below to get your copy of the ITM Pros & Cons now.

As a financial institution, running a branch today is not simple. Staffing is tighter, hiring is harder, and turnover is constant. Compliance...

Buying an ATM is one thing. Buying an ATM that actually works for your institution, your staff, and your customers is another. Too many leaders focus...

You’ve been tasked with buying or replacing an ATM at your financial institution. Easy enough, right? Just pick one out, get it installed, and go...